About Tax Collection

3 min

In this article

- Step 1 | Identify who you need to collect tax from

- Step 2 | Select manual or automatic tax

- Automatic tax collection with Avalara

- Manual tax collection

- Step 3 | (Optional) Create tax groups

- Step 4 | Include tax in the price or add it at checkout

Whether it's called sales tax, value added tax (VAT), or something else, the idea is the same. When a customer pays for an item- if needed - the merchant collects tax. They must then remit (pass along) the tax they collected to the local tax authority.

Before you take the time to set up tax, we suggest you figure out which tax rules apply to your particular business. That way, you won't tax your customers unnecessarily or fail to collect necessary taxes.

Important:

- Different tax rules apply in different locations. Consult with an accountant or your local tax authority for specific information relevant for your business.

- If you previously set up tax (and shipping) in a merchant account (e.g. in PayPal), remove these settings before starting.

Step 1 | Identify who you need to collect tax from

In most cases, you're required to collect taxes from:

- Customers in your location: This means customers in a location (country or state / province) where you have a physical presence, including where you have:

- A business registered with tax authorities

- A physical premises

- An office

- An employee

- Customers in locations where you passed a minimum threshold: Some merchants are required to collect tax in locations where sales exceed a certain threshold of sales (in money or in the number of transactions).

Important:

- Check with your local tax authority or accountant to find out who you are required to collect sales tax from.

- US tax laws for online businesses have changed significantly over the last few years, and new laws are still being interpreted. If you collect tax in the US, make sure you're aware of these ongoing changes.

- Tax regulations change from time to time. Check for updates periodically.

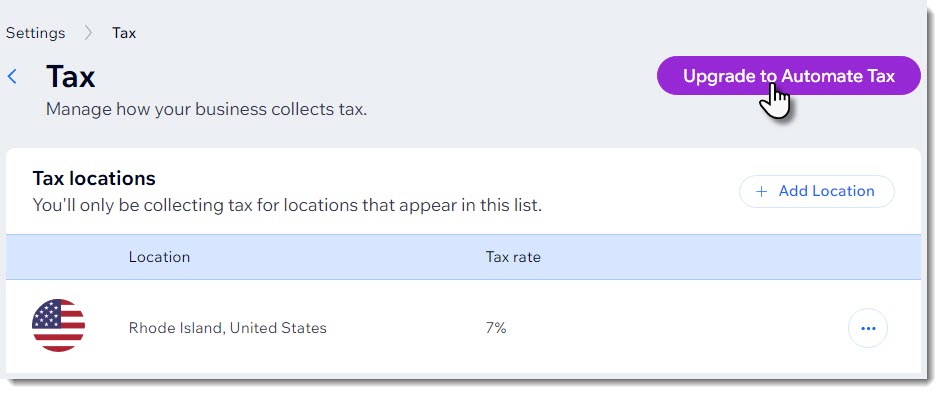

Step 2 | Select manual or automatic tax

Wix offers 2 methods of tax collection. You can set tax rates manually or automate tax collection using Avalara.

Automatic tax collection with Avalara

Avalara is a third-party app that calculates tax based on up-to-date tax rules. When rates change, your store tax updates automatically.

- Learn more about automatic tax collection.

- Learn more about creating tax groups through Avalara.

Notes:

- Avalara is available for use in sites that have upgraded to a Premium plan or Studio plan that supports automated sales tax.

- Calculating tax with Avalara is not currently available for sales in Brazil and India.

Manual tax collection

With manual calculation, you select the location or locations where you need to collect tax and manually enter the relevant tax rates. If the rates changes, it's up to you to update it.

Learn more about setting up manual tax calculation.

Step 3 | (Optional) Create tax groups

If you sell items that are taxed at different rates, you can create tax groups to stay in compliance with local tax regulations.

For example, if the default tax rate in your location is 10%, but children's clothes are tax free, you can set up a tax group for children's clothes and assign it a 0% rate.

You can create tax groups whether you're managing tax manually or the automatic method.

- Learn more about creating tax groups with Avalara.

- Learn more about creating tax groups using manual tax calculation.

Step 4 | Include tax in the price or add it at checkout

In some countries, such as the US, prices don't include tax and the sales tax is added during checkout. In other countries, prices are displayed with the tax already included.

You can select whether you want to include tax in your prices.