Wix Bookings: Setting Up Tax Collection

2 min

In this article

- How to start setting up tax for your business

- Tax calculation using the manual method

- Automatic tax calculation

Set up tax collection to make sure you're in compliance with local tax regulations. Your clients see these tax details at checkout.

Note:

Go to Tax in your site's dashboard to access your tax settings.

How to start setting up tax for your business

Before you begin setting up taxes, it's a good idea to understand the rules that apply to your business. This way, you'll avoid charging customers extra taxes or not collecting them when you need to.

Learn more about setting up tax for your business.

Notes:

- Different tax rules apply in different regions. Consult with an accountant or your local tax authority for specific information relevant to your business.

- In order for clients to see the correct tax details during checkout:

- Set up tax for your location(s).

- Select the correct business address from the Business Info drop-down. If you type the address but don't click to select it, it may not save, and the correct tax rates may not appear.

Tax calculation using the manual method

Wix offers two methods of tax collection. You can set tax rates yourself using the manual or automate tax collection using Avalara.

Using the manual method, you select the location or locations where you want to select tax (e.g. California) and then manually enter the tax rate (e.g. 7.25% for California). If the rate changes, it's up to you to update it.

Learn more about setting up manual tax calculation.

Automatic tax calculation

Wix also offers automatic tax calculation through Avalara. You can select the location(s) where you want to collect tax, and Avalara applies the correct rate. With Wix Bookings, the same tax rule is applied to all customers during checkout, regardless of their location. Learn more about automatic tax collection.

Note:

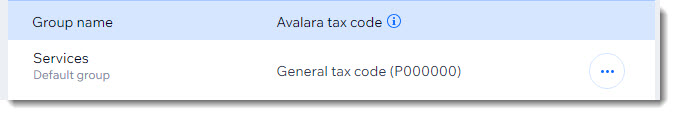

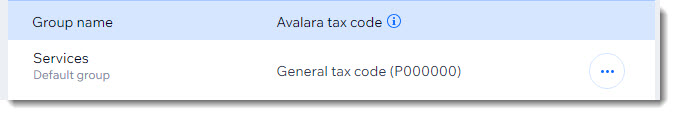

By default, if you use Wix Bookings, all your services are part of the services tax group. This group is set to collect the default sales tax (VAT) rate for services in each location. Learn more about assigning codes to your tax groups.