Chargebacks in Wix Payments

6 min

In this article

- Chargeback fees

- Understanding chargeback reasons

- Filing a dispute against a chargeback

- Timeframe to dispute a chargeback

- Tracking your chargeback's status

When a payment is labeled as a Chargeback in your Wix Payments account, it means the funds were returned to your customer. A customer generally requests a chargeback when they don't recognize the payment, or when the goods/services were defective, not as described or not delivered at all.

Unlike a regular refund request, where it's just between you and your customer, a chargeback also involves banks and payment networks (e.g. Visa, Mastercard, American Express, Afterpay, etc). This begins with the customer and their card or BNPL provider, who manage the chargeback process.

For card payments, customers can usually initiate a chargeback within up to 120 days after the payment was settled and get an immediate refund. For BNPL payments, the timeframe is 14 days. Wix is made aware of the chargeback only after it has occurred, and will update your account with relevant information as we receive it.

Any chargeback requires an investment of time and resources from the parties involved (Wix, banks, payment networks, etc.) and, as such, if you receive a chargeback, you incur a chargeback fee.

Chargeback fees

If you receive a chargeback, you incur a chargeback fee. Regional chargeback fees are broken down by the appropriate currency as follows:

- Canada: 15.00 CAD

- European Union:15.00 EUR

- Switzerland: 15.00 CHF

- United Kingdom: 15.00 GBP

- United States: 15.00 USD

If you file a dispute against the chargeback, and if you win the dispute, the chargeback fee is returned to you, along with the payment value.

Understanding chargeback reasons

When a customer files a request for a chargeback against your business, you can see the reason for it in your Wix Payments dashboard.

Click below to learn more about chargeback reasons:

Your customer claims they don't recognize the payment

Your customer claims to have paid more than once for the same payment

Your customer claims they've not received what they purchased

Your customer claims they've cancelled a recurring payment

Your customer claims the purchase is not as described / defective

Your customer claims they've received a counterfeit product

Your customer claims a misrepresentation of your sale terms

Your customer claims they've cancelled the purchase

Filing a dispute against a chargeback

As the merchant, you can either accept the chargeback or dispute it. Accepting the chargeback means that the funds remain with your customer. If you have documents to prove the validity of the payment, in most cases you can dispute it through your Wix Payments account.

If you believe a chargeback to be unjustified, we recommend you dispute it. A win, or partial win, will improve your chargeback ratio and help to protect the integrity of your Wix Payments account.

Important:

Many banks / payment networks require you to submit your evidence documents in English. However, if the bank / payment network in your dispute operates in another language, you may submit your evidence documents in that language.

Show me how

Timeframe to dispute a chargeback

Under the chargeback reason you can see the deadline for filing a dispute. After this date, the chargeback becomes final and you will no longer have the option to dispute.

Below are the different timeframes for disputing a chargeback and receiving a resolution. Wix Payments and its payment processors (Adyen/Stripe) define these timeframes, which means they may be shorter than those defined by credit card or BNPL providers.

Payment network | Timeframe to dispute a chargeback | Maximum timeframe for receiving the dispute's resolution |

|---|---|---|

Visa | 9 days | 55 days |

Mastercard | 40 days | 70 days |

American Express | 14 days | 90 days |

Diners | 40 days | 45 days |

Discover | 20 days | 120 days |

Union Pay | 25 days | 45 days |

JCB | 40 days | 45 days |

Affirm (BNPL) | 15 days | 15 days |

Afterpay (BNPL) | 14 days | 30 days |

Klarna (BNPL) | 12 days | 100 days |

PayPal (chargeback filed from customer's PayPal dashboard) | 10 days | 17 days |

PayPal (chargeback filed from customer's bank) | 10 days | 100 days |

Important:

- Wix is not liable for chargebacks incurred while using our platform. The outcome of a chargeback dispute is not determined by Wix, but by the issuer banks and payment networks involved. The dispute resolution is final and cannot be changed.

- When a chargeback leads to a negative balance in your Wix Payments account, Wix.com may charge your bank account by direct debit to cover the missing amount.

Tracking your chargeback's status

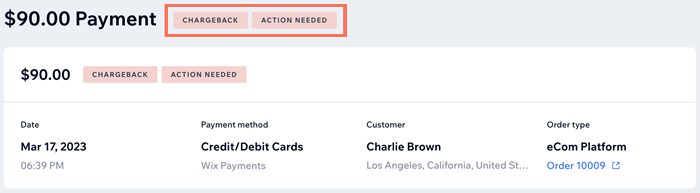

You can always monitor your chargeback's status from your Wix Payments dashboard. Go to your Wix Payments dashboard and see the status next to the relevant payment. The possible chargeback statuses are listed below.

- Action needed: You received a chargeback and can choose whether to accept it or dispute it. You're still within the timeframe to submit the dispute.

- Expires in "X" days: You received a chargeback and can choose whether to accept it or dispute it. You have the indicated number of days to submit the dispute.

- Expired: The time frame for filing a dispute has passed. The chargeback's status is now final and cannot be changed.

- Final: You received a chargeback but cannot dispute it. This status cannot be changed.

- Accepted: You received a chargeback and accepted the claim. The funds remain with your customer.

- Disputed: You received a chargeback and filed a dispute against it. It is now in review by the relevant card or BNPL provider.

- Lost: The card or BNPL provider have reviewed your dispute and found your evidence insufficient to prove the charge is legitimate. The funds will remain with the customer, and you will not be able to dispute the decision through Wix Payments.

- Won: The card or BNPL provider have reviewed your dispute and decided to recognize the payment as a legitimate charge. The funds will return to your Wix Payments account along with the chargeback fee.

Note:

The Payment ID visible in your payments table is a reference for your Wix Payments account only. It's not linked, nor can be referenced, to processors such as Affirm, Afterpay and Klarna.