Access all of Your 1099-K Forms

2 min

Wix Payments reports your gross payments to the Internal Revenue Service (IRS) using a 1099-K form, as long as you meet the federal requirements.

There are a number of reasons why you may receive more than one 1099-K form from Wix. Reasons can be related to your Wix Payments account configuration, changes to your account type, or the number of accounts in use within the previous tax year.

Receiving multiple 1099-Ks | Likely reasons |

|---|---|

For the same website |

|

For different websites |

|

If you receive multiple 1099-K forms, you'll need to consider the gross payments on each to understand the total gross payments you’ve made through Wix Payments.

To view 1099-K forms from Wix Payments:

- Sign in to your Wix account on desktop.

- Go to Wix Payments Accounts in your dashboard.

- Locate the relevant account(s).

- Click View.

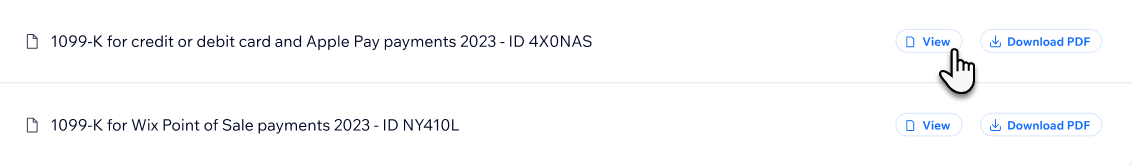

- Click Tax Documents.

- Click View on the relevant 1099-K.

You can expect your 1099-K form(s) for the preceding year to be available in the first quarter of the new year.