About VAT in Chile

2 min

In this article

- Updating your payment details

- FAQs

Wix charges Value Added Tax (VAT) on our services to customers in Chile in accordance with the Chilean tax code.

If you are a VAT registered business in Chile with a VAT number from the Servicio de Impuestos Internos, you may be eligible for a tax exemption.

You can add your VAT number to your Wix account by updating your payment details. The tax exemption will apply to your next subscription payment.

Updating your payment details

Re-enter your payment details to add your VAT number and receive your tax exemption.

To update your payment details:

- Go to Premium Subscriptions in your Wix account.

- Click the More Actions icon

next to the relevant subscription.

next to the relevant subscription. - Click Update payment method.

- Choose the subscriptions you want to update and click Next.

Note: This option will only appear if you have other Wix subscriptions in your account. - Click Next after reviewing the plan details on screen.

- Click Use another payment method.

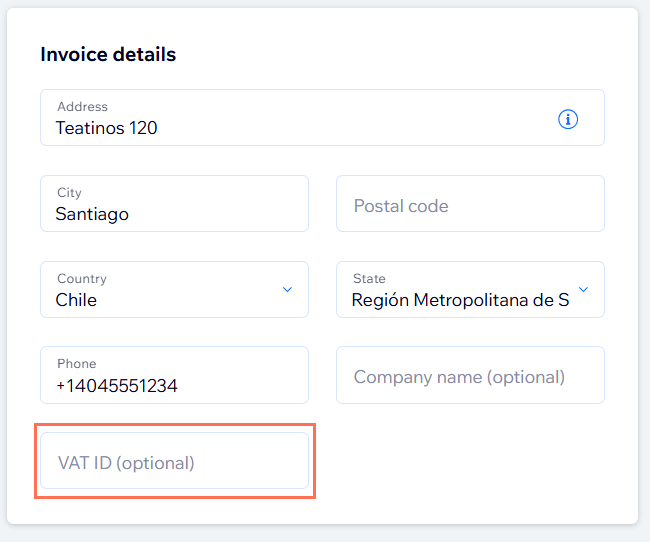

- Re-enter your card details and add your VAT Number to the VAT ID field.

- Click Update.

FAQs

Click a question below to learn more about tax in Chile.

What is a tax identification number?

What happens if I do not have a tax identification number?

How does Wix determine which customers are subject to tax?