Wix Invoices: Creating a Revenue or Tax Report

1 min

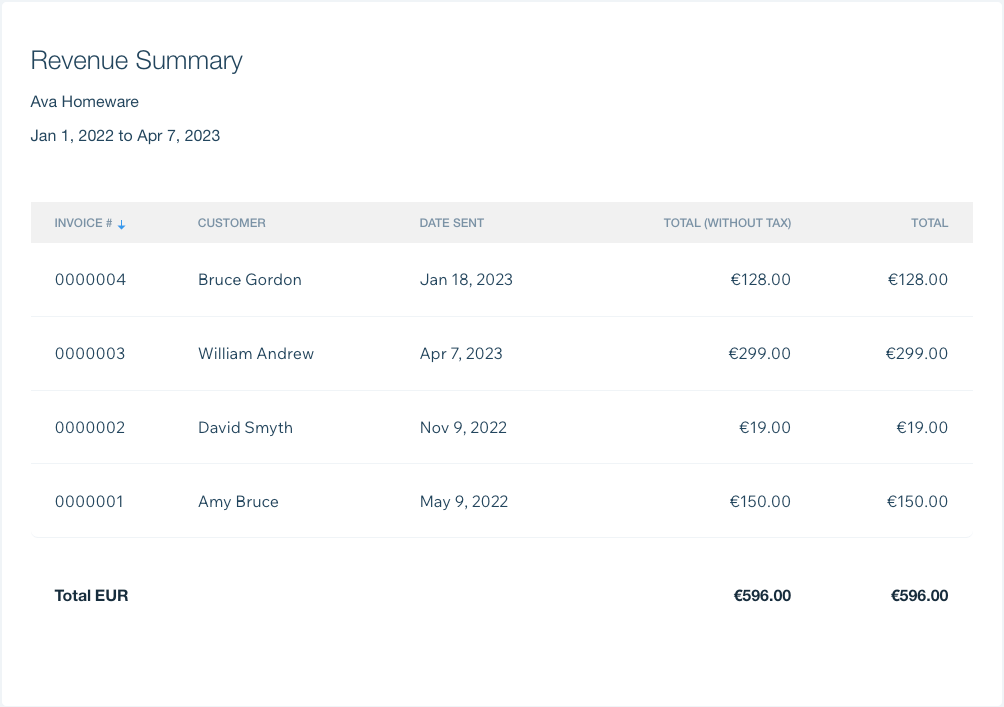

Use revenue and tax reports to keep track of how much your business has billed. Choose a time period and run reports listing all amounts invoiced or all taxes invoiced during this period. At the bottom of your report you'll see a total figure.

Important:

We recommend consulting with an accountant regarding taxes collected from your customers and additional tax obligations.

To create a revenue or tax report:

- Go to Invoices in your site's dashboard.

- Click the More Actions drop-down at the top right and select View reports.

- Click Create Report under the type of report you'd like to run:

- Tax Summary: View all taxes billed during a certain period.

- Revenue Summary: View all amounts billed during a certain period.

- Set the report's date range by selecting start and end dates in the Date Range section.

- Click the Revenue drop-down and select a report type:

- Cash Basis: Displays data on invoices paid during the date range.

- Accrual Basis: Displays data on all invoices sent during the date range, including both paid and unpaid.

- Export or print the report:

- Export: Click Export to CSV to download your report in CSV format.

- Print: Click Print to print the report.